Palm Beach County Resources

Delray Beach First-Time Homeownership Program

The purchase assistance program has been temporarily closed. All future updates will be provided on this page.

The Purchase Assistance strategy was established to provide affordable housing for the first-time homebuyers through the City of Delray Beach.

The goals of the program are to increase:

- Homeownership opportunities

- Improve the condition of existing housing units

- Contribute to the City's overall neighborhood improvement efforts

Program Features

The strategy provides assistance to those who are seeking to purchase in the City boundaries. The private lender will provide as much of a mortgage loan as the applicant can afford and the City will subsidize the remainder of the purchase price with available grant funds.

Additional features include:

- Below market interest rates

- 30-year fixed mortgage rates

- Homes priced may not exceed 90% of the average area purchase price in the statistical area for new construction and existing properties and may be purchased depending on the buyer's current income and debt

- Deferred gap financing and closing costs assistance through 0% interest deferred loans held as second mortgages up to $75,000

- Provision of homebuyer/homeowner education and training to ensure successful homeownership

- Forgivable no interest loans made for "gap" financing purposes, principal reduction, payment of closing costs

- Subsidies are provided in the form of a second mortgage for a period of 10 years for loan amounts less than $35,000 and 15 years for loan amounts of $35,000 or more

- Maximum purchase price limit is $568,557.

Buyer Qualifications

- Obtain a certificate through the homebuyer education course

- Must meet lender credit standards & have bank pre-approval letter

- First-time homebuyer includes single parent who has been divorced and displaced within the 12 month period prior to application, and whose children are under the age of 18; who have not owned a home within 3 years of the date of application for housing assistance or a displaced victim of domestic abuse

- Must contribute 2% of the total purchase price at time of closing

- Must not have assets more than $200,000

- Housing expenses (PITI) cannot exceed 40% of gross monthly income.

For more information, please contact communityneighborhood@mydelraybeach.com.

The State Housing Initiatives Partnership (SHIP) Program assists income eligible homebuyers with the purchase an existing property or a new home. Assistance may include gap financing, down payment and closing costs, and rehabilitation repairs needed to make the unit habitable. Rehabilitation is defined as repairs or improvements needed for safe and sanitary habitation, to correct substantial code violations, to improve accessibility for persons with special needs. Property must be located within the City limits of Boynton Beach, Florida.

Terms:

1. Repayment loan/deferred loan/grant: Deferred loan secured by a note and mortgage.

2. Interest Rate: 0%

3. Years in loan term: 15 Years

4. Forgiveness: The loan is forgiven at the end of the 15-year term.

5. Repayment: No repayment as long as the loan is in good standing and no default occurs.

6. Default: The loan is in default if any of the following occurs during the loan term: sale, transfer, or conveyance of property; conversion to a rental property, vacating of property, loss of homestead exemption status; failure to occupy the home as primary residence, refinancing with cash out or debt consolidation, or subject to a Reverse Mortgage. If any of these occur, the outstanding balance of the deferred loan is due and payable to the City of Boynton Beach.

In cases where the qualifying homeowner(s) die during the loan term, an income eligible heir who will occupy the home as a primary residence may assume the loan. If the legal heir is not income eligible, chooses not to occupy the home, or the house is sold, transferred, or refinanced, the outstanding balance of the loan will be due and payable to the City of Boynton Beach. An income-eligible heir must execute a Mortgage and Promissory Note. The Mortgage will be recorded in the public records of Palm Beach County.

In the event where failure to pay the superior mortgage lien holder leads to foreclosure and/or loss of property, the City may foreclose and take legal actions to recover the secured mortgage funds.

Applicant must be a first-time homebuyer. Applicant(s) must complete a 6-hour Homebuyer Education class from a HUD-approved housing counseling agency or website prior to loan closing.

Additional Information:

1. Applicant(s) must secure a fixed-rate, 30-year first mortgage loan from an institutional first mortgage lender with a rate not to exceed 0.5% over the “Primary Mortgage Market Survey”. All bank and loan fees cannot exceed 6% of the loan amount.

2. Eligible properties include the purchase of existing single-family homes, duplexes,

townhouses, villas and condominiums. Mobile homes are ineligible.

3. Eligible property must be located within the City limits of Boynton Beach.

4. Applicant(s) minimum cash contribution shall be as follows:

• Very Low Income or Disabled Households – $1,000 or 1% of the purchase price, whichever is less. Includes all items pre-paid by the applicant;

• Low Income – $2,000 or 1.5% of the purchase price, whichever is less. Includes all items pre-paid by the applicant; and

• Moderate Income – $3,000 or 2% of the purchase price whichever is less. Includes all items pre-paid by the applicant.

5. Applicant(s) who have monetary assets exceeding $25,000 (gifts included in the asset calculation) must contribute one-third (1/3) of the funds in excess of $25,000, toward the purchase. The exception to this would be if the applicant has funds in a retirement fund accessible only by termination or retirement. This contribution would count toward the minimum down payment requirement.

6. Applicant(s) must not own any other property used for residential purposes.

7. Property will be inspected by a City Building Inspector or Construction Coordinator as part of the application review process, to ensure that the funding amount to be awarded would fully cover the cost to bring the property into compliance with minimum building codes intended to provide safe and sanitary habitation, as well as corrections needed to remedy substantial code violations.

8. Subordination of the SHIP program loan will not be approved for purposes other than to refinance the first mortgage on the subject property to improve rate and/or term. The City of Boynton Beach will only allow One (1) subordination approval during the term of the SHIP program loan. The City may consent to a subordination of its loan to allow the homebuyer to receive cash out for emergency home repairs that become necessary to sustain homeownership and maintain the health and safety of the residents.

9. The City of Boynton Beach reserves the right to deny any subordination request it deems not in its’ or the homeowner’s best interest i.e. exorbitant closing cost fees (closing cost may not exceed 6% of loan amount), interest rate may not exceed 1.5% of the current first mortgage. The authority to approve subordinate requests or exceptions to the Subordination Policy will rest the City Manager or his/her designee.

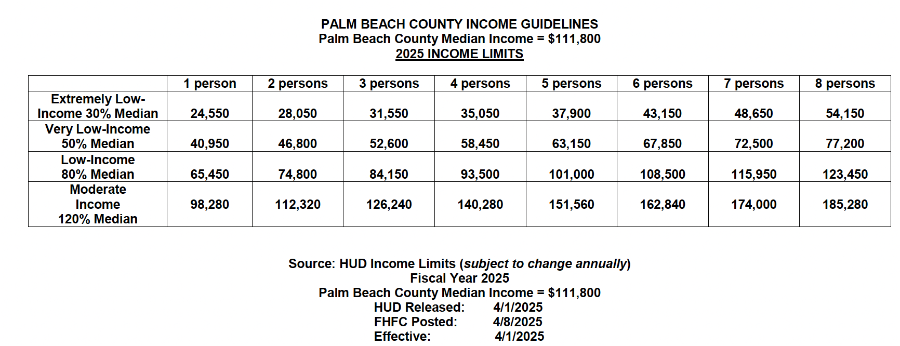

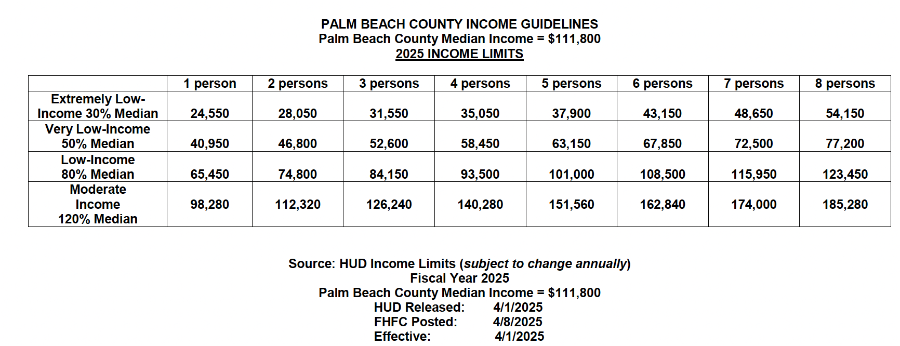

Applicant’s gross household income (income from all sources before taxes and withholding for every household member, age 18 and over) may not exceed 120% of the area median income, as determined by the U.S. Department of Housing and Urban Development (HUD). Eligible applicant(s) will be assisted based on funding availability. Applicant(s) will be selected on a first-qualified, first-served basis. Only completed applications, with all applicable supporting documentation will be processed.

Order of Ranking Priority is as follows, with first-time applicants being a priority in each category:

a. Special Needs households

a. Very low

b. Low

c. Moderate

b. Essential Services Personnel

a. Very low

b. Low

c. Moderate

The Village of Wellington State Housing Initiative Partnership (SHIP) Program

The Village of Wellington is participating in the Florida Housing Finance Corporation’s State Housing Initiatives Partnership (SHIP) Program. SHIP is an affordable housing program enacted into law in 1992 through the William E. Sadowski Affordable Housing Act and is funded by a percentage of documentary stamp surtax on real estate transfers. This program is offered to low to- moderate-income single-family Wellington homeowners to assist with repairs and rehabilitation projects that will bring their homes into compliance with the Florida Building Code and address any health or safety hazards, per HUD guidelines, on a "first-qualified, first-served" basis.

These grants do not cover purchase, rental, or foreclosure assistance, irrigation, wells, landscaping, fencing, screens, or screen enclosures.

The online application portal for these programs is closed.

Program Assistance

- Urgent Repair funds will be awarded in a grant with no repayment required.

- Housing Rehabilitation funds will be awarded as a 0% interest deferred payment loan secured by a recorded mortgage and note for 5 years. The loan is forgiven at the end of the 5-year term. Payment shall be deferred until one of the following events occurs: Sale of the property, transfer of property, property is no longer owner occupied, or term has expired.

| Eligible Resident | Assistance Type | Maximum Award Amount |

| Homeowner | Urgent Repairs | $15,000 includes 10% contingency |

| Homeowner | Owner-Occupied Rehabilitation | $50,000 includes 10% contingency

|

- Before you apply:

- Be sure to visit the documents checklist webpaBe sure to check our list of eligibility requirements.

- Be sure to have a valid email address

- Only one application per household will be considered. Please do not submit multiple applications.

- If the application is missing documents, the application will be marked incomplete.

- The applicant must complete and upload all required fields on the application for all household members 18 years and older.

- The application can be completed on a computer, laptop, smartphone, tablet or iPad.

- Internet Explorer does not support the application portal.

- If an applicant needs access to a computer, they can stop by the Wellington Library Branch and use the computers during library hours. To view these hours, please CLICK HERE. Applicants can call the Library to book a librarian to show them the computer and scanner equipment. The applicant is responsible for providing all documents and entering all application information. Library and Village staff do not complete applications.

The CDBG and SHIP applications will be available online through our Neighborly portal. Once on the Neighborly website, click the REGISTER tab use a valid email address, and create a password. Once this account is created you will have access to the portal to complete the application that is associated with your email. If approved for the program you will have access to this portal throughout the grant program. You do not have to complete the application in one sitting, you can "save" and come back at a later time.

Applicants

Applicants will be ranked for assistance based on a first-qualified, first-served basis with priorities for

To find out who qualifies as special needs, click here

To find out who qualifies as essential service personnel, click here

The following are the qualifications for what special needs are and the order of priority.

- Applicants with other special needs

- Aging out of foster care

- Survivor of domestic violence

- Disabling condition

- Receives Supplemental Security Income or disability payments

- Order of priority assistance

- A homeowner with developmental disabilities

- Other household members with developmental disabilities

West Palm Beach Housing and Community Development

- The Serving Our Seniors (SOS) Program is designed to provide temporary assistance for critical needs to low income elderly residents in the city of West Palm Beach. The Program will assist seniors in the event of an emergency and/or financial hardship for eligible activities.

This program provides one-time financial assistance to seniors over the age of 62, not to exceed $600.00 in order to provide resources such as:

- Utility assistance;

- Reimbursement of the City's Fire Assessment Fee; and

- Handicapped accessibility.

The Program will only support the costs not covered by any other programs providing duplicate services and/or resources.

- The Housing Stabilization Program is designed to provide a one-time financial assistance to families and individuals, who are residing or homeless in the city limits of West Palm Beach, gain or maintain housing stability. This program targets two populations of persons facing housing instability:

- Families or individuals who are still housed within City limits but are at imminent risk of becoming homeless and;

- Homeless families or individuals in the city limits of West Palm Beach and seeking housing to remain within city boundaries

- The Homeward Bound Program offers individuals who have been chronically homeless in the City of West Palm Beach the opportunity to reunite with their families back home.

Procedures include meeting all requirements such as: legal identification including government issued photo identification, personal interview, clearance of all warrants or court probation, and funding availability.

Should you desire to apply for the program, please contact the Community Services Division at (561) 804-4970 (TTY: 800-955-8771).

Helpful Links

Affordable Housing Palm Beach County

Palm Beach NSP Program Information

Florida Housing Bond Program

Florida Housing Homebuyer Wizard

NSP Foreclosed Homes for Sale (Palm Beach)

FHLB Homebuyer Program

Home Steps Freddie Mac

Home Path Fannie Mae

First Look Fannie Mae

Palm Beach Housing Finance Authority

Down Payment Assistance-Individual Cities (Palm Beach)

Down Payment Grants

There are many down payment grants and housing assistance resources available.Check-out the list below to find the right program for you!

Palm Beach NSP Program Information

Palm Beach Housing and Community Development

Affordable Housing in Palm Beach County

Palm Beach Housing Finance Authority

Housing and Community Development Programs

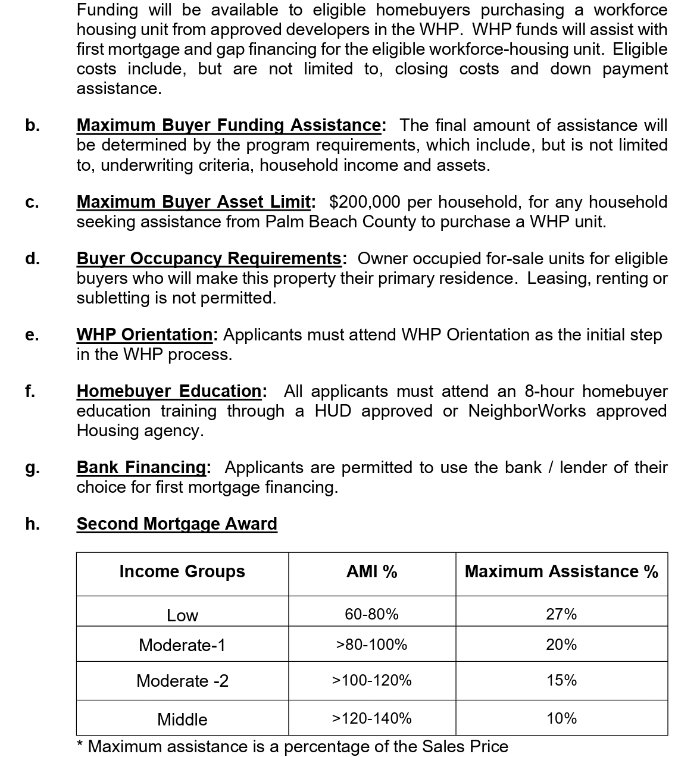

Workforce Housing Information

Housing and Community Development FAQs

Government Grants

Housing and Urban Development (HUD)-Learn about homeownership from HUD

Property Appraisals

An appraisal helps to establish a property's market value - the likely sales price it would bring if offered in an open and competitive real estate market.

Palm Beach Property Appraiser

Property Taxes

Property taxes are the amount of taxes due on real estate or property, in which an owner is required to pay on the value of that particular property. The Palm Beach County Real Estate Property Tax Collector contact information is below.

Palm Beach County Tax Collector

Utilities

Helpful links for transferring or connecting your water/sewer and power utilities.

Palm Beach Water/Sewer Utilities Account Information

Palm Beach Water/Sewer Utilities FAQs

Palm Beach Power Utilities-Florida Power & Light Company